tax sheltered annuity taxation

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Its similar to a 401 k plan maintained by a for-profit entity.

Annuities are taxed at the time of withdrawal regardless of the.

. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Ad Annuities are often complex retirement investment products.

A tax-sheltered annuity plan gives employees. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. Taxation can also be deferred if the taxpayer exchanges the undesirable annuity for another annuity product in a tax-free exchange under IRC Section 1035. Of course this is assuming you have a pre-tax annuity.

Learn some startling facts. That kind of sounds like a Roth account but theres a catch. New Jersey residents who receive pension or annuity incomeshould consider asking their fund manager to withhold New Jersey Income Tax from th ose payments.

A tax-sheltered annuity is a type of investment vehicle that lets an employee make pretax contributions into a retirement account from income. For more information on estimated tax payments see Tax Topic Bulletin. GIT-8 Estimating Income Taxes.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. So if you wrote a check from your taxable bank or brokerage account to pay the premium. The reason to withhold.

Take a Closer Look at the Main Types of Annuities Common FAQs. To file estimated tax payments when due. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

The contributions made to a non-qualified annuity arent taxable. Because the contributions are. Ad Compare Multiple Annuities Each With Their Own Tax Benefits.

However any growth or earnings on your initial. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Keeping records will help.

A non-qualified annuity is you purchased with money you have already paid taxes on. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. How taxes are paid on an.

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Deferred Annuity Definition Formula Examples With Calculations

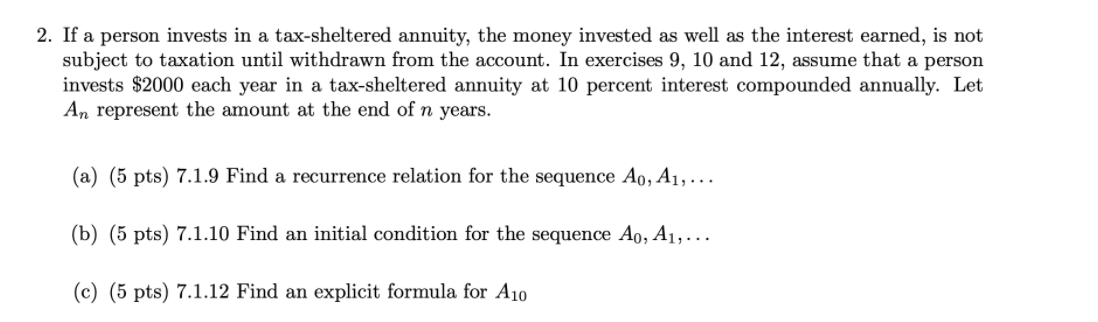

If A Person Invests In A Tax Sheltered Annuity The Money Invested As Well As The Interest Earned Is Not Subject To Taxation Until Withdrawn From Course Hero

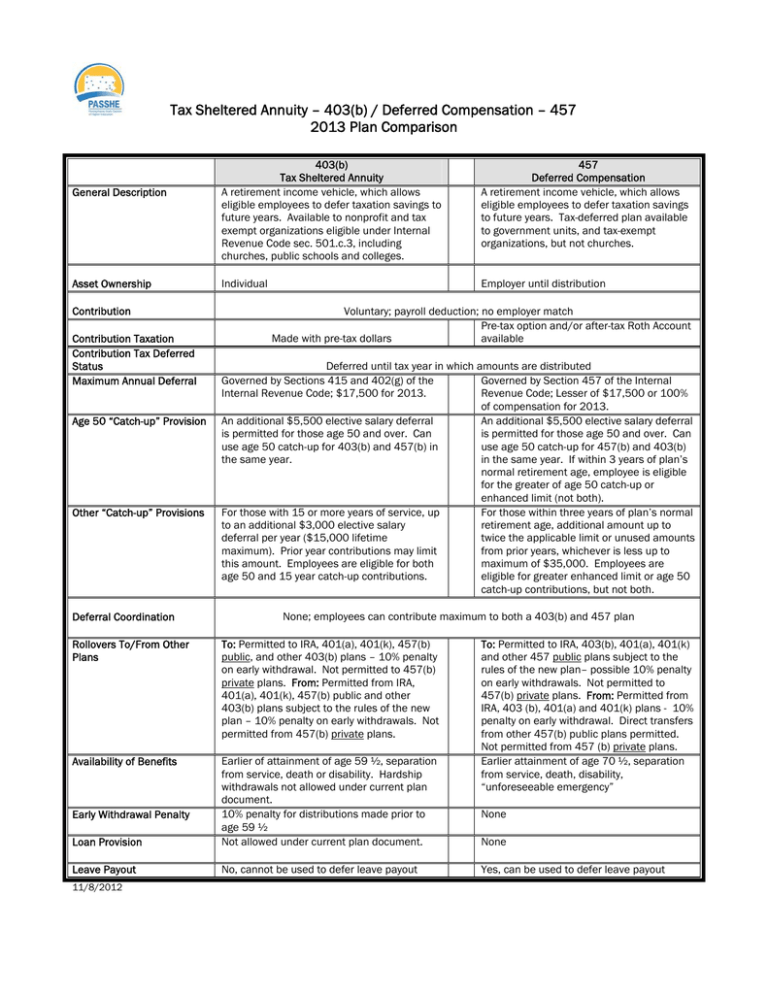

The Tax Sheltered Annuity Tsa 403 B Plan

Withdrawing Money From An Annuity How To Avoid Penalties

Solved 2 If A Person Invests In A Tax Sheltered Annuity Chegg Com

What Is A Tax Deferred Annuity Due

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Are Annuities Taxed

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Retirement Plans Pensions And Annuities